During May, the Belgian tax authorities send out tax returns in brown envelopes to all taxpayers. Depending on your situation, you may have some questions about filling in the form! What does the tax return consist of? How should the boxes be completed? What documents do you need to collect? What should you do if you make a mistake? The Expat Welcome Desk explains it all.

Have you received your tax return but aren’t sure what to do with it ?

In paper form (the brown envelope) or in electronic form (tax-on-web) the tax return is, at present, sent to everybody who has been registered in the national register since 1 January 2024.

What does this brown envelope contain ?

The tax return in paper format is accompanied by a number of documents:

- The explanatory brochure that helps you fill in your return;

- The draft, or "preparatory document", printed on beige paper, which is intended to help you complete your tax return. This document does not need to be returned but it is important to complete it before you fill in your return – this will ensure that you enter the codes and their amounts correctly on the return and do not forget any;

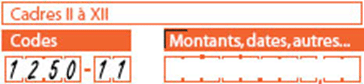

- The written return itself, printed in red and white, containing your personal data, to be returned stamped to the scanning centre after having been completed, dated and signed before 30 June 2024. There are no pre-printed codes in the return form. You therefore have to enter the codes and the corresponding amounts yourself;

In the first 6 boxes, enter your code.

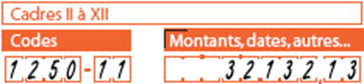

You then have 10 boxes to enter the amount corresponding to the code. Note! Your amount should be aligned to the right, with the last two boxes used for cents only. If you need to enter a round amount (without any cents), enter "00" in the last 2 boxes.

For example, to enter an amount of EUR 32,132.13:

- The accompanying sheet printed in white and green for sending in any annexes if necessary;

- The return envelope to send in your return and any annexes. The address that should appear in the envelope window is that of the scanning centre.

Which documents do you need to complete your tax return ?

In order to fill in your tax return, you must first gather various documents that may entitle you to tax reductions: the 281.10 payslip (to be obtained from your employer), the statement of your childcare costs, the certificate for your mortgages, pension savings, gifts to recognised institutions (donations and legacies), service vouchers, costs incurred in order to save energy, alimony payments, etc.

What should I do if I have not received a paper return ?

It is always possible to complete your return electronically via MyMinfin (until 15 July 2024). This requires your electronic identity card and a suitable card reader, the itsme® app or a digital key. This means that you will no longer need to request a paper return.

If you still wish to complete a paper return, you should request a return form from your Personal Tax Centre.

PLEASE NOTE :

- If you have received a proposed simplified return (in your eBox or by post by the end of May 2024 latest), you will not receive a paper return. The proposed simplified return provides a simulation of your tax calculation based on the tax information available to the Belgian finance administration and the amount to be paid or received. If you receive a proposed simplified return, you should not, as a rule, submit any return unless it shows incorrect information, in which case you should correct it (the same rules apply for the deadlines depending on your situation: 30 June / 15 July / 16 October).

- From 31 January 2024, "token digital key" will no longer be available for logging on to government online services. However, digital keys with a security code by e-mail or via the mobile application will still be available.

Is it possible to use an agent to submit my return ?

Yes. Anybody who needs to file a return can call on the services of an agent (accountant, chartered accountant, tax consultant, etc.) This agent must have a company number.

First, you and your agent must create a mandatein the secure application"Mandates". Your agent will then complete your return and submit it via MyMinfin (Tax-on-web). Your agent will be able to submit your return up to 15 July 2024. However, if you have any specific income (i.e. self-employed earnings or foreign professional returns), the deadline is 16 October 2024.

What should I do if there is a mistake or omission in my tax return ?

You can no longer amend your paper return yourself after it has been submitted. We would ask you to contact your personal tax centre as soon as possible to have your error corrected. If you have submitted your return via Tax-on-web, you can amend your return yourself via MyMinfin (Tax-on-web) until 15 July 2024 (once only).

What happens if I submit my return late ?

If you have not submitted your return by the deadline indicated on it, you risk a fine or an increase in tax.

The administration may also resort to the procedure of ex officio taxation. In that event, it has a period of four years to assess or amend your tax.

Can I ask for more time to submit my return ?

In some, exceptional, cases, it is possible to obtain an extension, subject to the following conditions :

- Your request must be justified by "force majeure" or "just cause", i.e. an event that you could not foresee or avoid, and which is not of your own making. For example: you are seriously ill, your documents have been lost because of theft or a fire, you are abroad for an extended period (work abroad, seafarers, etc.), etc..

- Your request must be submitted before the normal deadline expires (30 June 2024 if you submit a paper return / 15 July 2024 if you file your return via MyMinfin Tax-on-web).

To request an extension, call your personal tax centre giving:

- Your surname, forename and national registration number;

- The method of submission for your return: using the paper form or via Tax-on-web;

- The reasons for your request;

- The date of the extension desired.

Your application will be reviewed by your centre. It will inform you whether the request is approved or refused.

What factors could affect my tax return ?

If there has been a change in your life, this may also have an impact on your tax situation :

- Your medical situation : a tax deduction will be calculated on the basis of the type and amount of the substitute income you have been paid.

- Your professional situation : as a salaried worker, you must include the various items of income listed on the 281.10 form in your tax return. You should also note that if you receive reimbursement of commuting expenses, you are entitled to an exemption. Since this amount is not indicated on form 281.10, you should mention it in box IV, under 7.a. If you have a complementary activity, the income generated may sometimes be taxable. It is therefore important to obtain information on your situation. People who have unfortunately lost their job must declare the unemployment benefit received in box VI of the return as substitute income. Pension amounts received must be declared in box V, A, 1, in accordance with your 281.11 form.

- Your family situation : if you are recently married or legally cohabiting, you must report your new status in box II of the return for the year following the year in which you were married. The year following the marriage, the return is filed jointly by both spouses. The end of legal cohabitation or a divorce must also be entered in box II of the return.

If your spouse or legal cohabitant has died, two tax returns must be filed and you must indicate whether you wish to be taxed jointly or separately in box II. For joint declarations, it is the age rather than gender that determines which member of the couple must complete which column. Specifically, the older partner must complete the left-hand column, and the younger the right-hand one. After the birth of your child, you must report the allowance for the maternity leave as replacement income (box IV). You may also be entitled to a tax reduction for childcare costs. Childbirth allowance and child benefit are not taxable.

- A mortgage loan : in the Walloon region (only), you are entitled to tax relief for mortgages.

How can I simulate my tax calculation ?

You can run an anonymous simulation of your tax calculation via Tax-calc.

Foreign income ?

If you have income in one of the following countries: France, Germany, Greece, Italy, Luxembourg, Spain or the Netherlands, there is an app to help you determine:

- How to report this income on your return;

- In which country this income will be taxed;

- If this income is subject to municipal tax.

For more information, see this web page.

Good to know

- The documents entitled “Part 2” are only relevant for people who are self-employed or company directors.

- Officials of the European institutions with tax residence in Belgium must complete the tax return by declaring all their income worldwide. However, they do not have to mention their EU salary, but have to tick two special boxes (1062-05 and 1020-47) exempting them from taxes on their salaries. They must attach the tax exemption certificate issued by their institution. If they have other income in Belgium or abroad (e.g. property), they must declare it under the corresponding codes.

- For officials of the European institutions who do not have their tax residence in Belgium the return must be sent to the scanning centre, undated and unsigned but with the tax exemption certificate issued by their institution and mentioning that they are non-resident in Belgium for tax purposes. If someone in this category of officials has income from Belgian sources, it must be declared in a non-resident tax return. In this case you must notify your relevant tax office and complete this form. Once this application has been submitted, you will receive the return each year. You must also inform your office if there is a change of address and/or your marital status (in case of marriage, legal cohabitation, separation, divorce, death).

Do you need help ?

Up to 27 June 2024, an employee of the FPS Finance can help you fill in your tax return. This can be done by appointment only, by telephone or at one of the FPS Finance offices. To do so, you must first make an appointment using the telephone number specified on the envelope for your return or on 02/575 56 67. When making an appointment, you will need your national register number.

If you have chosen telephone help and you miss the first call, the assistant will leave a message and call you back. You do not need to call back yourself. If you also miss the second call, you should make an appointment for another day (as soon as possible).

Warning !

You will not be able to access help with your return after 27 June 2024.

To make sure that you are being contacted by a genuine employee of FPS Finance, here is what to look out for :

- The call will come from a number like 02 572 57 xx;

- An FPS Finance assistant will only contact you if you have made an appointment, and only on the date agreed with you;

- They will confirm your identity with your national registration number;

- Your assistant will know most of the details of your income and other items to be included in your return. For example, he can tell you over the phone what your salary was in 2020.

People may fraudulently impersonate calls from FPS Finance. Please hang up immediately if:

- The person contacting you does not know your full name;

- You are asked to pay for the help;

- The person you are talking to offers to come to your home or asks you to go somewhere;

- Your contact asks you for your bank account number, your credit card number, a password, the PIN for your identity card, your home address or your email address.

MORE INFORMATION ABOUT YOUR TAX RETURN ON FINANCE.BRUSSELS

STAY TUNED TO OUR WEBSITE, THE EXPAT WELCOME DESK WILL SOON BE ORGANISING A WEBINAR ON TAXES !